Introduction

Dubai, a global hub for innovation and luxury, is redefining real estate investment with the launch of the Middle East’s first licensed real estate tokenization project. Spearheaded by the Dubai Land Department (DLD) in collaboration with the Virtual Assets Regulatory Authority (VARA), the Central Bank of the UAE, and the Dubai Future Foundation, this initiative leverages blockchain technology to make property ownership more accessible, transparent, and efficient. By allowing investors to buy fractional shares of properties starting at just 2,000 dirhams (approximately $540), Dubai is democratizing a market traditionally reserved for high-net-worth individuals.

This article dives deep into Dubai’s pioneering real estate tokenization efforts, exploring how they work, why they matter, and what challenges lie ahead. From the innovative Prypco Mint platform to the broader implications for global investors, we cover the full scope of this transformative trend in one of the world’s most dynamic real estate markets.

Dubai Pioneers Real Estate Tokenization: A New Era for Property Investment

Explore the key facets of this groundbreaking initiative:

- What is Real Estate Tokenization?

- Dubai’s Leadership in Tokenization

- The Prypco Mint Platform

- Other Players and Partnerships

- Benefits and Challenges

- Future Outlook

Prerequisites

No advanced technical knowledge is required to understand this article, but a basic grasp of blockchain technology or real estate investment concepts will enhance your experience. We’ll break down complex terms to ensure clarity for all readers, whether you’re an investor, industry professional, or simply curious about Dubai’s latest innovation.

Content

What is Real Estate Tokenization?

Real estate tokenization transforms property ownership by converting it into digital tokens on a blockchain. Each token represents a fraction of a property’s value, allowing investors to buy and sell shares without needing to purchase the entire asset. This process leverages blockchain’s secure, transparent ledger to record transactions, ensuring trust and traceability.

In traditional real estate, high costs often limit investment to wealthy individuals or institutions. Tokenization lowers this barrier, enabling smaller investors to own parts of premium properties. For example, instead of buying a $1 million apartment, you could purchase a $540 share. This approach increases liquidity, as tokens can be traded more easily than physical properties, and reduces transaction costs by streamlining processes.

Dubai’s Leadership in Tokenization

Dubai’s real estate market, valued at $18.2 billion in May 2025 alone, is a global powerhouse. The DLD’s launch of the region’s first licensed tokenization project positions the city as a trailblazer. Announced in March 2025, this initiative aligns with Dubai’s 2033 real estate strategy to become a global leader in innovative property investment. The project is supported by a robust regulatory framework involving VARA, the Central Bank of the UAE, and the Dubai Future Foundation, ensuring compliance and investor confidence.

On May 19, 2025, VARA updated its regulations to include real-world asset (RWA) tokenization, allowing tokenized properties to be traded on secondary markets. This regulatory clarity, combined with Dubai’s tech-forward ecosystem, makes it an ideal testing ground for blockchain-based real estate solutions.

The Prypco Mint Platform

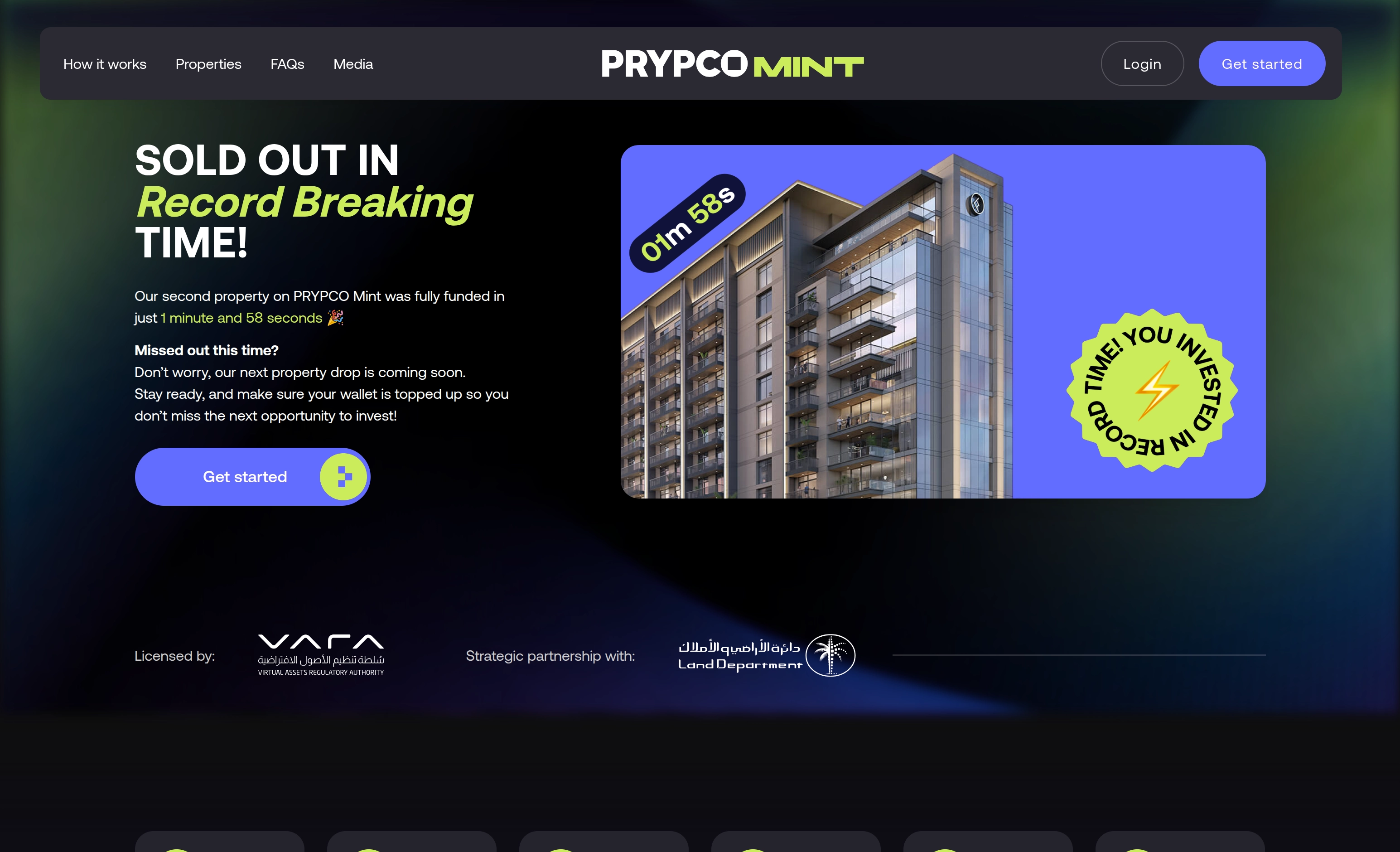

At the core of Dubai’s tokenization efforts is the Prypco Mint platform, developed with Prypco and Ctrl Alt Solutions. Launched in May 2025, it allows UAE ID holders to buy fractional ownership in ready-to-own properties starting at 2,000 dirhams ($540). Built on the XRP Ledger, the platform ensures secure, transparent transactions, with property title deeds tokenized for traceability.

Investors can access detailed property information, including pricing, risk factors, and technical specifications, enabling informed decisions. Transactions are conducted in UAE Dirhams, avoiding cryptocurrency to simplify adoption during the pilot phase. Zand Digital Bank serves as the banking partner, while VARA and the Central Bank provide regulatory oversight. The DLD plans to expand the platform globally, integrating additional platforms in future phases.

Note:

The Prypco Mint platform is currently limited to UAE ID holders. Ensure you have a valid UAE ID if you plan to participate in the pilot phase, and stay updated on global expansion plans.

Other Players and Partnerships

Beyond Prypco Mint, other platforms like SmartCrowd and Stake are driving tokenization in Dubai. SmartCrowd offers investment opportunities starting as low as AED 500, with transparent records and fast trading. Major developers are also joining the trend: Damac has partnered with Mantra to tokenize $1 billion in properties, while MAG Group signed a $500 million deal with Mavryk to bring luxury projects to the blockchain.

On May 1, 2025, MultiBank Group, MAG, and Mavryk announced a $3 billion RWA agreement, further signaling Dubai’s commitment to scaling tokenization. These partnerships highlight the growing ecosystem of private and public players collaborating to modernize real estate investment.

Benefits and Challenges

Real estate tokenization offers transformative benefits:

- Fractional Ownership: Investors can own shares of premium properties with minimal capital, democratizing access.

- Increased Liquidity: Tokens can be traded on secondary markets, unlike traditional properties.

- Transparency and Security: Blockchain ensures tamper-proof records, reducing fraud risks.

- Global Reach: Tokenization opens Dubai’s market to international investors, boosting demand.

However, challenges remain:

- Regulatory Complexity: While VARA’s rules provide clarity, ongoing compliance is critical.

- Security Risks: Blockchain is secure, but surrounding systems like exchanges must be fortified.

- Adoption Hurdles: Traditional investors may hesitate to embrace tokenized assets without education.

Future Outlook

The DLD projects that tokenized real estate could reach $16 billion by 2033, representing 7% of Dubai’s property transactions. As the Prypco Mint platform expands globally and integrates new features, it could attract a diverse investor base. The success of this pilot phase will likely influence other cities, positioning Dubai as a global model for blockchain-based real estate.

However, scaling will require addressing regulatory, technical, and cultural challenges. Continued collaboration between government, developers, and tech providers will be key to sustaining this momentum.

Conclusion

Dubai’s real estate tokenization initiative marks a bold step toward a more inclusive and efficient property market. By leveraging blockchain through platforms like Prypco Mint and partnerships with industry leaders, the city is setting a global standard. While challenges like regulation and adoption persist, the potential to transform a $16 billion market is undeniable. Investors and stakeholders should watch closely as Dubai paves the way for the future of real estate investment.